An Extraordinary Report

ExxonMobil: 'Global oil and natural gas supplies virtually disappear without continued investment'.

Summary

In a recent report (August 2024) the ExxonMobil Company projected a substantial drop in oil production within the next few years unless there is ‘substantial new investment’.

The following statement is provided on page 4 of the report.

Our Outlook reflects oil production naturally declining at a rate of about 15% per year. That’s nearly double the IEA’s prior estimates of about 8%.

This increase is the result of the world’s shifting energy mix toward “unconventional” sources of oil and natural gas. These are mostly shale and dense rock formations where oil and gas production typically declines faster.

To put it in concrete terms: With no new investment, global oil supplies would fall by more than 15 million barrels per day in the first year alone.

At that rate, by 2030, oil supplies would fall from 100 million barrels per day to less than 30 million – that’s 70 million barrels short of what’s needed to meet demand every day.

The United States Energy Information Administration (EIA) published a similar forecast sixteen years ago. The response was the rapid development of the tight/shale oil (‘fracking’) industry. If we do not witness a comparable development of new oil sources within the next few years then the energy and process industries face wrenching changes. There could be serious disruptions in the supply of oil and oil products.

These disruptions, should they occur, will have profound process safety consequences. For example, there will be a greater focus on resilience in an environment where operating conditions are likely to change at short notice.

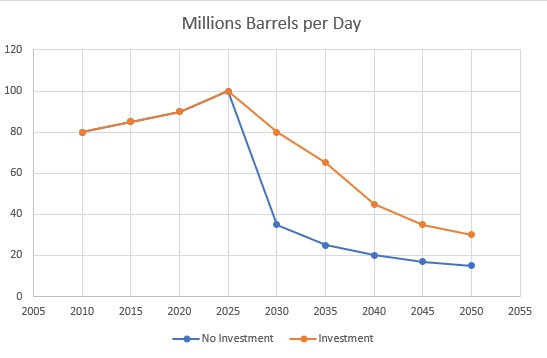

The ExxonMobil (XOM) company publishes an annual ‘Global Outlook’ report. The most recent report (August 2024) contains some disturbing forecasts. The sketch below is based on information in the report. (A much better looking and more detailed image is provided in the report itself.)

We can draw the following conclusions from the chart.

The world’s demand for oil in the last decade has risen from about 86 to 95 in millions of barrels per day. In spite of the growth in alternatives, such as solar panels and EVs, we are using ever increasing amounts of oil. The new sources of energy are supplementing, not replacing the fossil fuels.

The report assumes that long-term demand for oil through the year 2050 remains flat at about 100 million barrels per day. This assumption is not explained, but it may be based on an expectation that new sources of energy will start to replace the fossil fuels, in spite of their low energy density.

Oil supplies start to plummet around the year 2026 (that’s just a year and a half from now).

It is important to recognize that this report was published by ExxonMobil, the world’s largest publicly traded oil company, not by a fringe organization. Moreover, even within the oil and gas industry, ExxonMobil has a reputation for conservatism.

Investment Requirements

Starting at the the year 2026, the chart shows three scenarios.

No Investment

Investment in existing fields

New resources and projects needed

1. No Investment

The first scenario ― ‘No Investment’ ― is both unlikely and unrealistic. About this scenario the report says,

The world would experience severe energy shortages and disruption to daily lives.

Oil prices could rise by 400% ― by comparison, prices rose 200% during the oil shocks of the 1970s.

Within 10 years, unemployment rates would likely reach 30%. That’s higher than during the Great Depression of the 1930s.

Any policy that would ‘keep it in the ground’ is not just.

Were the supply of oil to drop to 30 million barrels per day just a few years from now, society as we know it would grind to a halt. For starters, virtually all of our commercial transport (trucks, trains, airplanes and ships) uses fossil fuels.

2. Investment in Existing Fields

The second scenario ― ‘Investment in existing fields’ ― is what is happening now. Companies and governments throughout the world continue to invest in fossil fuel projects (hence the ever increasing concentration of greenhouse gases in the atmosphere).

But, even if these organizations invest as much as they can, the XOM chart projects that oil production drops from 100 to 30 million barrels per day just a generation from now. Given that oil is utterly foundational to our modern way of living, that forecast is both startling and rather scary.

3. New Resources and Projects

In the report, we find the following statement,

Reducing emissions in “hard to decarbonize” sectors such as aviation, cement, steel, and others with unique energy needs will require the world to rely on the expansion of biofuels, carbon capture and storage and hydrogen, among other technologies.

The ‘big three’ industries that continue to rely on fossil fuels ― and that are crucial for everything we do ― are cement, urea (nitrate fertilizer) and steel. To say that these industries are ‘hard to decarbonize’ within just a few years is somewhat disingenous. For example, kiln electrification for the manufacture of cement is still in the experimental stage.

The three newish technologies mentioned ― biofuels, carbon capture and hydrogen ― face fundamental thermodynamic limitations. Based on the current state of these technologies it is unlikely that they can fill the gap shown in the chart in the short amount of time available.

Precedent

We seem to be faced with a dilemma. However, there is a precedent for the challenges that we face.

Sixteen years ago the United States Energy Information Administration (EIA) published the following chart. It is surprisingly similar to the one in the ExxonMobil report.

Like the ExxonMobil report, the EIA called for very large investments in ‘Unidentified Projects’.

And that is what happened. Those projects were the development of tight oil resources (fracking), mostly in the United States. Maybe something similar will happen now.

Process Safety Implications

If the more gloomy projections shown in the report turn out to be the case, then it is likely that oil prices will rise substantially. It is also likely that there will be interruptions in the supply of oil and oil products. Should that be the case then there will be a greater focus on resilience and adaptability, and less on operating efficiency. This in turn would mean that process safety professionals would spend more time on topics such as temporary operating procedures and management of change.